Use a Free Crypto Tax Calculator to create Tax Reports : So you bought some cryptocurrencies at the beginning of the year to make some good investments, but now tax season is around the corner and you don’t know how to pay taxes for your cryptocurrencies. Let’s look at why you considered cryptocurrencies a good investment a little more closely and for that, we need to first understand what are cryptocurrencies.

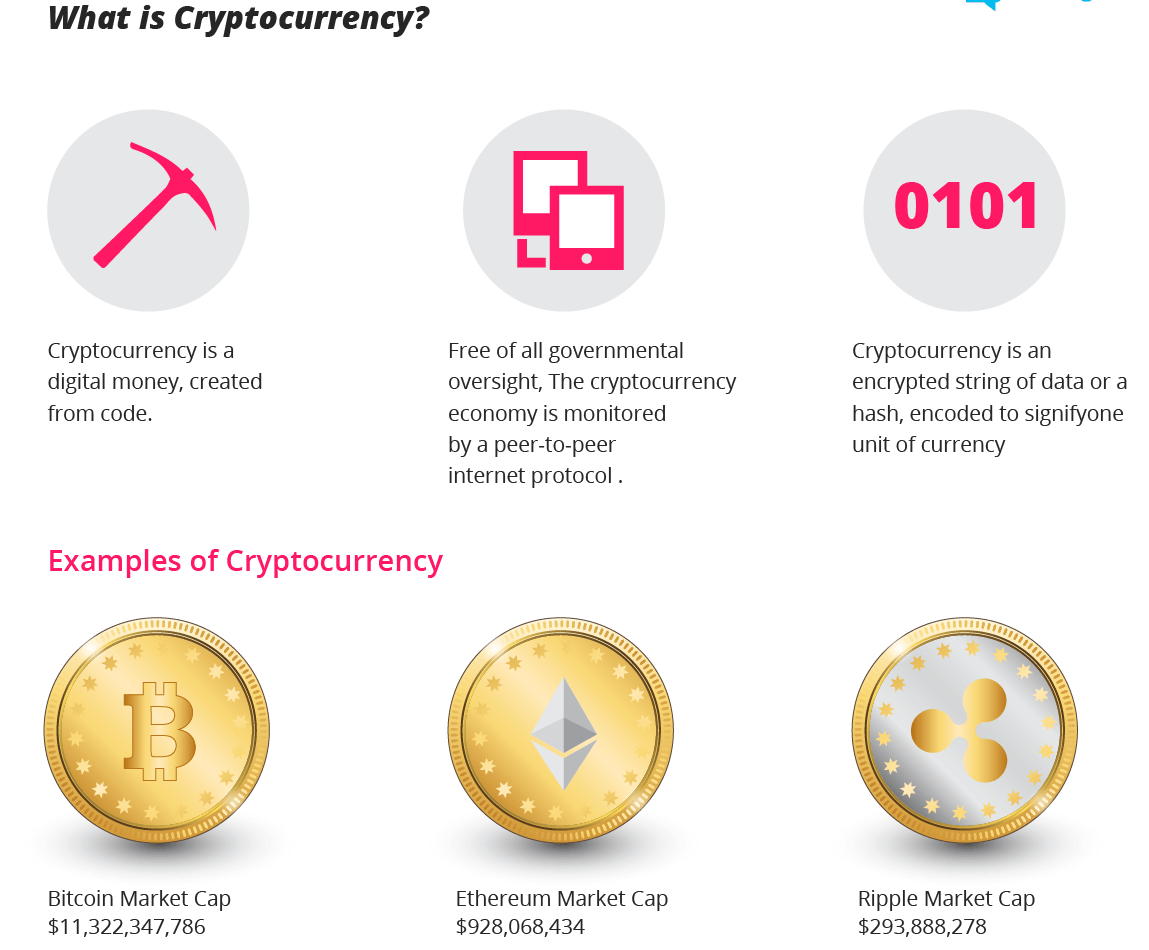

What is a cryptocurrency?

A cryptocurrency is a digital asset that can be used as a medium of exchange for online transactions. These digital assets are developed on an open-digital ledger technology called Blockchain. Blockchain, as the name suggests, is a chain of blocks. Each block is a set of transactions that have been recorded, these blocks are immutably linked to one another using strong cryptographic hash functions, creating a chain a.k.a., a Blockchain.

Why Cryptocurrencies?

There are a number of reasons cryptocurrencies are considered good investments, not just because they have ballooned in value over the past few years. Cryptocurrencies carry some inherent characteristics that give them advantages over traditional FIAT currencies, let take a look at some of these.

Decentralized

Cryptocurrencies are developed using blockchain. Blockchain is a decentralized system of record-keeping that uses distributed computing to verify and add transactions to a block. Since all transactions are verified through a network of computers and not just a single computer, distributed computing systems have the advantage of high Byzantine fault tolerance. Byzantine fault tolerance demonstrates a system’s ability to provide an accurate result when processes within it fail, the higher fault tolerance the fewer chances the system will produce an inaccurate result. So even if a computer within the network fails, other computers can compensate for it and produce accurate results.

Secure

Blockchain uses strong cryptography to link transactions within the chain. When a crypto-transaction is made, it is broadcast throughout the network for a group of computers called nodes to evaluate, these nodes are technically miners who have contributed their computing power to help authenticate transactions on the network.

When a transaction is verified it is added to a block that adheres to very strict cryptographic rules, the cryptographic rules that each block adheres to prevent any block from being modified. If a block within a chain is modified it will invalidate all subsequent blocks. All blocks are signed by the sender’s private key to prevent any duplication.

The fact that all transactions are verified by a network and unanimously authenticated make cryptocurrencies highly secure to transact with. Blockchain is an almost incorruptible system and maintains a high level of accuracy when it comes to record-keeping.

Immediate

Since blockchain is a Peer-to-Peer (P2P) system and all transactions are taking place between members of the same network transactions are almost immediate. Crypto-transactions take place between crypto-wallets. These digital wallets are used to store the private keys for your cryptocurrencies. Since all these wallets are on the same network transferring data between them is almost immediate, thereby, making transactions almost instant.

Cost-Effective

When you make a transaction with traditional FIAT currencies there are a number of intermediaries this transaction goes through. Each of these intermediaries charges you a processing fee to verify transactions, increasing the overall cost of transacting. Cryptocurrency transactions take place directly between peers on the same network and, therefore, there are no intermediaries, transactions are verified by nodes that receive newly generated cryptocurrency units for their services.

Crypto-Tax Regulations

Depending on the duration for which a cryptocurrency is held and the purpose for which it is used the tax regulations governing your cryptocurrency investment differ. Let’s take a look at home these regulations differ.

Crypto Held as Investment

If you have procured cryptocurrencies to make investments your tax liability will differ depending on how long you how them for. If you hold the cryptocurrency for a period longer than 1 year it will be taxed as a long-term capital asset. Long term assets are subject to taxes at the rate of 0%, 15%, and 20% depending on the income generated from them.

If the cryptocurrencies are held for a period of less than 1 year, they should be added to your gross income and will be taxed according to your Federal Income Tax bracket.

Crypto Received as Payment for Goods and Services

If you have received payment for goods or services provided by you in cryptocurrency, the currency value of the cryptocurrency on the day you received it will need to be reported for tax purposes. This requires you to keep track of the US Dollar value of the cryptocurrency every time you receive some.

Crypto Used for Trading

If you are trading with cryptocurrencies regularly, any profits/gains from such trades should be reflected in your gross total income which will be taxed in accordance with the relevant Federal Income Tax bracket. This requires you to keep a record of each trade you have made and its value in US Dollars.

Free Crypto Tax Calculators

Recording individual transactions and their US Dollar value can be quite a time-consuming task, that you may not necessarily have the time to do. Don’t worry, there are plenty of free crypto tax calculators available on the internet which can help you do everything from tracking your cryptocurrencies to filing crypto taxes. We have made a list of our picks for the top 3 free crypto-tax calculators.

eToro

eToro is one of the preferred free crypto-tax software used by crypto traders, miners, investors, and Chartered Accountants across this globe. This lightweight online app can monitor your crypto investments and provide you information relating to your total tax liability.

Recap

Recap is a free crypto-tax software that does much more than just tax reporting for you. This software is tied to some of the largest crypto-exchanges, allowing you to transfer all your transactions to the calculator quickly and efficiently. The software also allows you to track your investments and provides a real-time feed of your position.

ZenLedger

ZenLedger is a powerful free crypto-tax calculator that is used by traders, investors, accountants, and miners across the globe. This tool is linked to most crypto-exchanges and supports almost all cryptocurrency transactions. ZenLedger has also partnered with TurboTax to allow you to integrate your crypto-transactions with the rest of your tax report seamlessly.

Use a Free Crypto Tax Calculator to create Tax Reports