8 Ways to Align Your Fitness and Financial Goals for the New Year : It’s an easy argument to make that exercise is better for your mental, emotional and physical well-being but what if we told you it can also benefit your financial health. It may not be the first benefit that comes to mind when analyzing the benefits of prioritizing your fitness but there are several ways that exercising can help your wallet.

Fitness is increasingly on everyone’s minds as the New Year rounds the corner. Fitness and finance tend to be two of the main areas that we focus on when setting New Year’s resolutions. Any goals that fall into these areas can be daunting and overwhelming to take on. Not to mention that these areas of our lives tend to influence our general happiness and success.

Being able to streamline your physical wellness and financial goals to work symbiotically together can make tackling these goals more manageable and less intimidating. So, let’s dive into some of the ways that prioritizing your fitness can lead to your wallet thanking you long-term.

For starters, as you integrate healthier choices and fitness routines into your lifestyle, it’s likely that your confidence and belief in your ability to succeed will improve. As you feel increasingly capable of attaining physical fitness, you’ll feeling exceedingly capable of hitting financial goals.

There’s also a good chance that as you prioritize a fitness routine, you’ll start to experience increased restfulness from sleep. Having a consistent and healthy sleep schedule can help reduce the amount of money that you might spend on coffee or other unhealthy energy drinks.

Another financial benefit of developing a fitness routine is that you’re likely to also develop a consistent meal planning routine. Having a consistent meal plan can help reduce food waste, overall benefiting your wallet. Planning your meals ahead of time can help you stick to a food budget and allow you to look for sales ahead of time. By making healthy fitness and food choices, you might be inclined to cut out the weekly trip to the ice cream shop as well.

Additionally, the time that you spend working out is time not spent, spending money on other activities. With activities like movies costing anywhere from $15-30, a free hike can become an appealing activity for both your health and your financial wellness. By incorporating exercise into your lifestyle, you may be less inclined to go out and spend money at the bars or eating out at pricey restaurants.

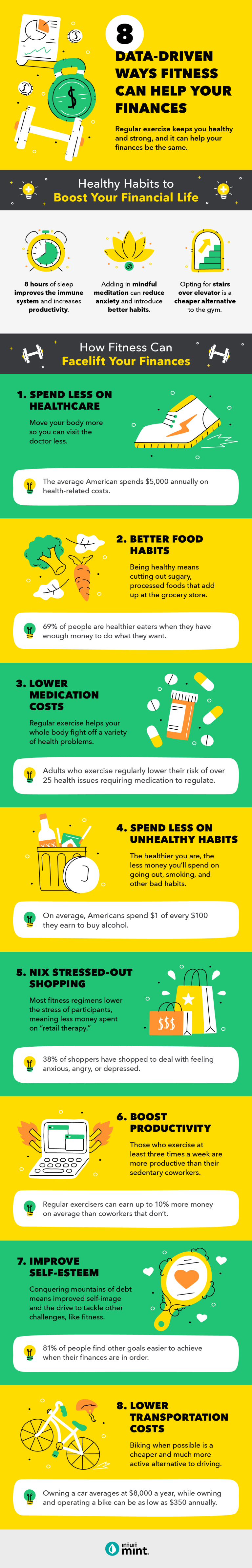

According to one resource, exercising can save you $2,500 a year in health costs. This doesn’t even take into consideration the additional ways you might be able to save by exercising. Check out the infographic below to explore even more ways that creating and sticking to a fitness routine can help you reach your financial goals. It might even be worthwhile to print this out and place it somewhere you can use it as a daily reminder as to why you made the New Year’s goals that you did.

Go out there and make your financial and fitness goals a reality!

Noelle Fauver is a contributing editor for 365 Business. She has a B.A. in Communication Studies from California State University, Northridge. She has experience in marketing, finance, and small business management.

Related Infographics about Ways to Align Your Fitness and Financial Goals for the New Year :