Are you Ready for Dental Insurance? In all probability, you are already aware of the impact good oral care has on your happiness and well-being. You would agree more if you’ve ever doubled up with toothache while traveling or attending an outstation conference. Or, if you were recommended a crowning while your teeth appeared in good shape to you.

The significance of proper dental care and treatment cannot be denied. Given the goodness of timely dental care, why would you wait for something painful to happen before you take an appointment with your dentist or health practitioner.

One factor that may deter anyone from pursuing a proactive strategy is the cost and if you are concerned about it too, then dental coverage plans are what you require at your earliest to keep your teeth in good condition.

Need for Dental Insurance

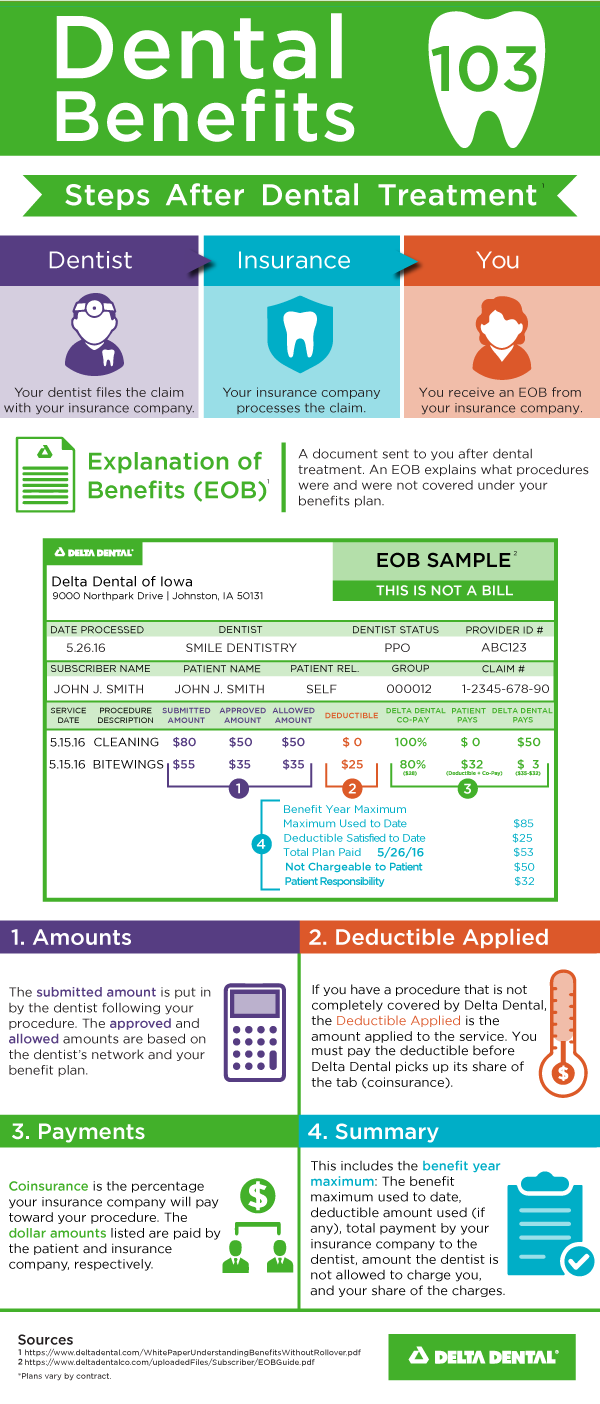

Maybe you already have a health insurance plan in place. However, it may or may not cover the costs for your dental treatment. Most exclusive dental plans provide coverage for the complete range of treatment – from preventative care to complex surgeries. Do note that dental issues like tooth pain, problems with fillings, swelling of gums, need for a crown or dentures, and Root Canal Treatment or RCT do not signal their coming.

The smallest of dental issues can necessitate medical interventions and cut deep dents in your pocket. For instance, Patrick Walters from Dencover explains that eating hard foods can break fillings, causing tooth pain. Given the unpredictable nature of dental issues, and how they can strike anytime, it’s worthwhile to get adequate coverage at the earliest.

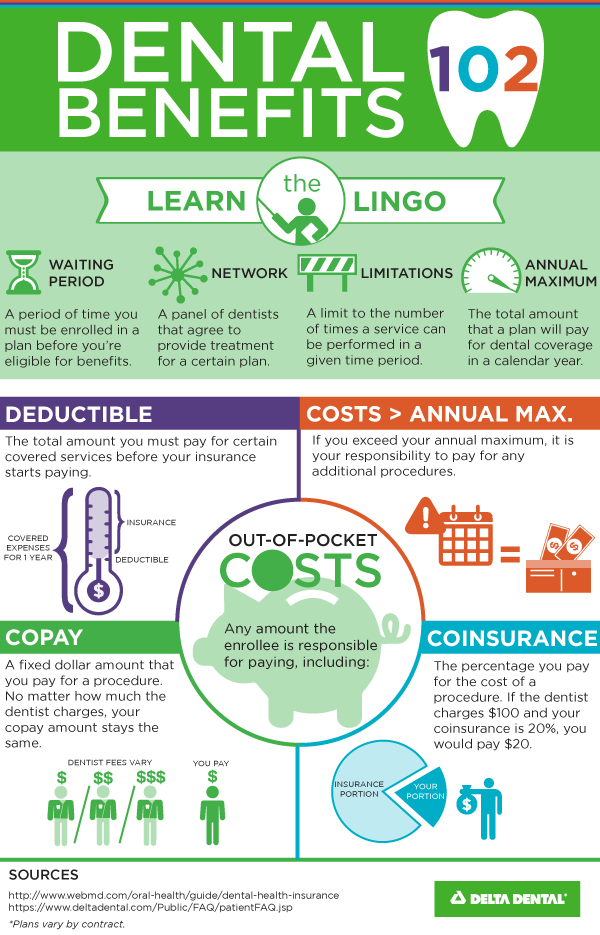

Points to Consider Before Purchasing Dental Insurance

These days, there is no dearth of dental plans to choose from. The challenge lies in purchasing the right one to align with your budget and health needs combined. More so, it works to check out the USP of the private dental insurance company you wish to link yourself within the UK. For instance, Dencover offers the widest range of dental insurance plans and the lowest qualification period around for private restorative treatment. If this fits your bill then it would pay you good returns to buy a plan from this Company. And if you need a dentist, consider this well liked dentist in Plantation.

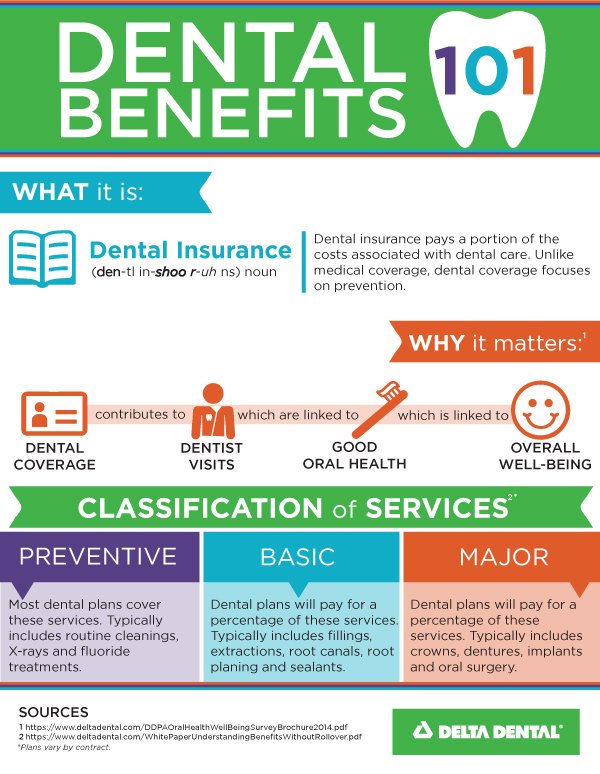

Dental Plans and Preventative Care

Sudden dental checkups, six-monthly ones, or annual preventive care for your teeth come at a cost. Even simple cleaning procedures, x-rays, or an annual visual inspection can take a toll on your finances. While most dental insurance coverage plans to take care of the total cost, including preventive care, there are many others that may provide only partial cover. This is provided preventative care fees is included in their terms and conditions. Check out the fine print thoroughly to avoid any disappointments later on.

Choose the Best Plan

Dencover’s dental cover helps you put in a claim for your check-ups and scaling – right from day one. You may want to consult the insurance representatives at Dencover to figure out the benefits of different plans and the costs you’ll incur every year. The most suitable dental plan for you would be the one that covers almost all types of preventive dental care along with major surgical interventions. Get yourself the dental plan you deserve, today.

Related Videos about Are you Ready for Dental Insurance?

Related Infographics :