5 Tips for Buying Cancer Insurance : The latest statistics show that cancer is the second leading cause of death globally. The study states that every sixth death in the world is caused by cancer.

Because of this sobering fact, it pays to be prepared if you or a family member develops a form of cancer in the near or distant future. Having a health insurance policy is a good start to protecting yourself and your loved ones.

However, typical health insurances only cover a portion of the physician, hospital, cancer therapy, and prescription drug bill. If you want to be fully prepared and armed against a possible fight with one of the deadliest diseases in the world, you need to get good cancer insurance.

Purchasing Your First Cancer Insurance

Below are five useful tips you should follow when purchasing your first cancer insurance policy:

-

Check your current health coverage first

Before you start shopping around for your cancer insurance, go over your current coverage first.

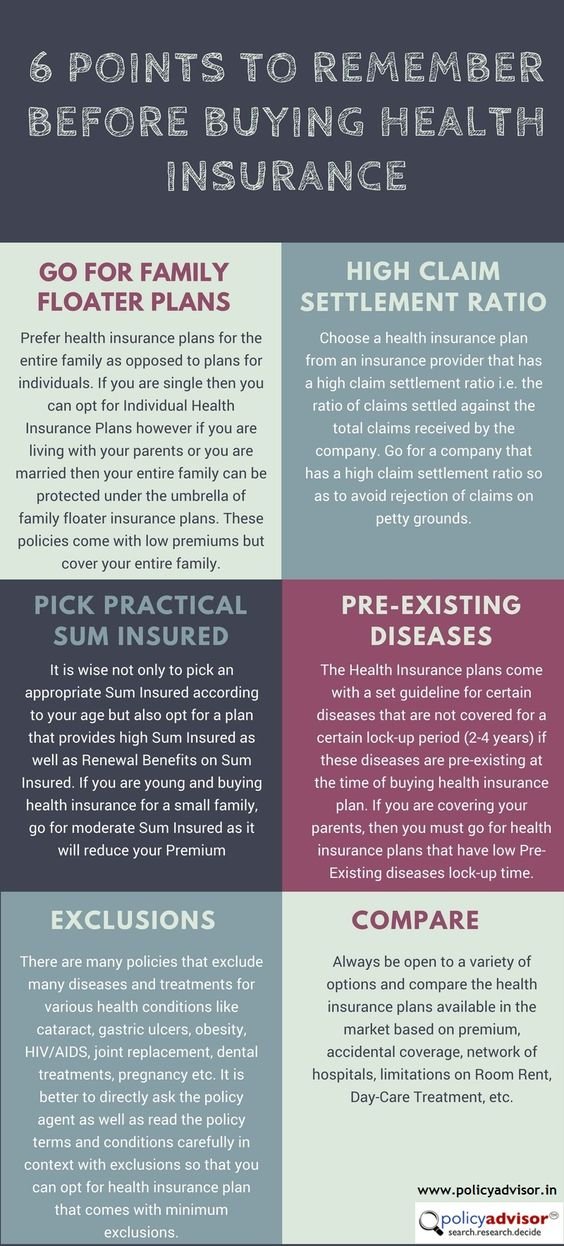

Check if your current health plan has any gaps related to cancer. If it does, find out from your provider if you can upgrade it. By doing so, you will be able to save some money when you upgrade your policy. In case this is not possible, start looking at different products.

Most health insurance policies do not cover all cancer treatments. This could lead to many out-of-pocket expenses related to cancer treatment. Most people think that they only have to pay the deductible of their health insurance and everything else will be covered. Plus, your health insurance only covers medical expenses, which does not help with your everyday bills if you have to be out of work for an extended period of time. While with many cancer insurance policies, you can use the money however you like, which includes housing, utilities, food, etc. Keep this in mind when looking at the available options.

-

Understand the payout structure

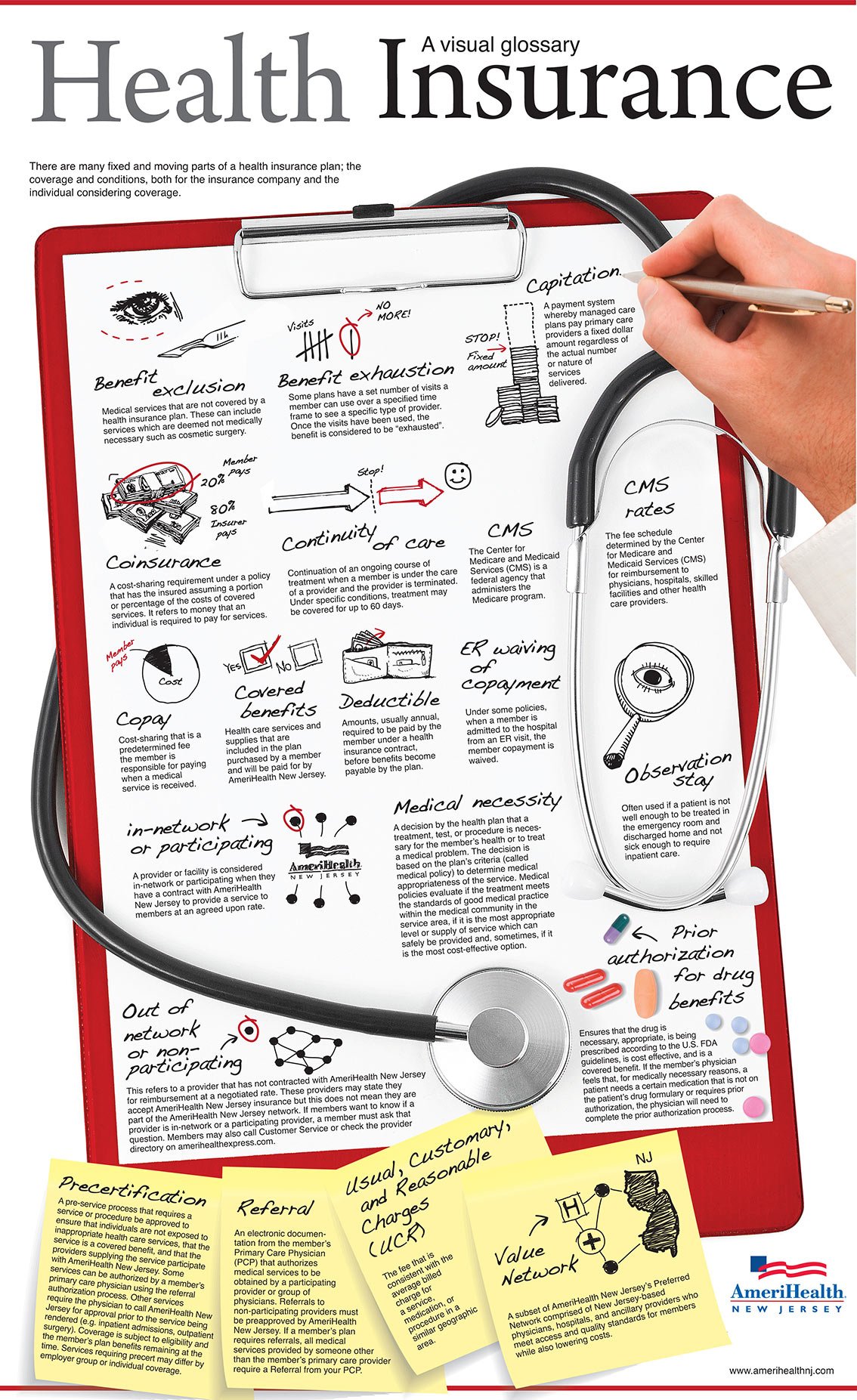

Cancer insurance policies come with different payout systems. A plan with lump sum payouts, for instance, pays large benefits upfront upon diagnosis of cancer. The policy holder will receive the money directly to use however they need.

Plans with indemnity policies, on the other hand, will pay insurance holders a certain fixed amount for each benefit listed in the plan over the course of treatment.

A policy that offers both of these payout options would work to your advantage. This would give you a lump sum payout upon initial diagnosis and then provide additional cash benefits over the course of treatment.

-

Check the plan’s lookover period and overall flexibility

In insurance terms, the lookup period is the given timeframe wherein you can review and cancel your plan if you are not content with it. This time period is typically 30 days from the effective date of coverage. Unfortunately, many plans do not come with this feature. If you are still unsure about a particular policy, make sure it comes with this feature.

Additionally, your cancer insurance plan should give you choices in terms of the payment schedule. By being able to choose whether to pay your premiums monthly, quarterly or yearly, you will have an easier time including the fees in your budget.

-

Choose a plan with a long policy term

Many cancer insurance policies often come with a fixed term for covering your needs. However, cancer diagnosis and treatment is often a long process. As such, make sure the coverage you purchase will cover you for a long period of time.

If you have the option to choose between 10 to 30 years of coverage, select the longest term. And if you can find one that offers coverage for life, you would do better to purchase that type.

-

Read the fine print of the policy

Finally, before purchasing a particular plan, understand fully how the provider defines cancer. This is because some policies exclude coverage for certain types of cancer.

Plans differ as well in terms of waiting periods. This refers to the number of days you have to wait to be eligible to receive the stated benefits. In most policies, the waiting period is 30 days.

Lastly, if you already had cancer before, some policies will automatically decline coverage. Others will consider coverage if you have been cancer-free for a minimum of 10 years. If you were already diagnosed before, make sure you find out if you will still be covered before signing any policy.

Having cancer insurance will ensure you get treatment if you will be diagnosed with the disease. The payout you will receive will also help cover other expenses if you can’t work because of your ailment.

But to experience all these benefits and more, make sure you get the right cancer insurance.

If you are overwhelmed by the options, get help from an insurance advisor. He or she will help you in choosing one that suits your needs, lifestyle, and budget by exploring all available options with you.

Author :

Eric Fribush is the owner of eSupplemental.com, a supplemental insurance agency, and has specialized in supplemental insurance since 2003. He helps clients compare the top supplemental insurance policies so they can make an informed and educated decision on what is best for them and their family. Eric is an independent agent not affiliated with any one insurance provider, which enables him to give unbiased recommendations on which policies would benefit a client the most.

Related Videos about Tips for Buying Cancer Insurance :

How to Purchase Health Insurance With Cancer : Insurance Tips & Answers

Definition of Cancer Insurance : Insurance Tips & Info

Cancer Insurance Risk : Insurance Tips & Info

Related Videos about Tips for Buying Cancer Insurance :

5 Tips for Buying Cancer Insurance

best cancer insurance plans, best cancer insurance policy in india 2018, sbi cancer insurance, lic heart and cancer policy, Buying Cancer Insurance, best cancer and heart insurance, insurance for pre existing cancer patients, cancer insurance in kerala, icici pru cancer protect, Buying Cancer Insurance