GST – The Most Significant Tax Reform In India : The significance of GST in India has been a hot topic for economists, politicians, businessmen, and consumers. It has been debated over and over again since its inception to implementation and thereafter. To understand why the implementation of GST carries such relevance in the history of tax reform in India history, we have to go through the changes it has brought about.

Is GST Helping The Indian Economy For The Better?

GST aims to eliminate all the loopholes that were a part of the old taxation methods. To achieve this the government will implement austerity measures and simplified taxation to promote businesses. Businesses through their expansion generate employment and pay taxes in return for selling their goods and services. This will help boost the economy both in the short term and long term.

The GST model has been implemented to bring equilibrium in tax relaxations, exemptions in relevant cases, proper filing of taxes, use of advanced technology to keep track, and to help grow businesses.

What Changes Has GST Brought In India?

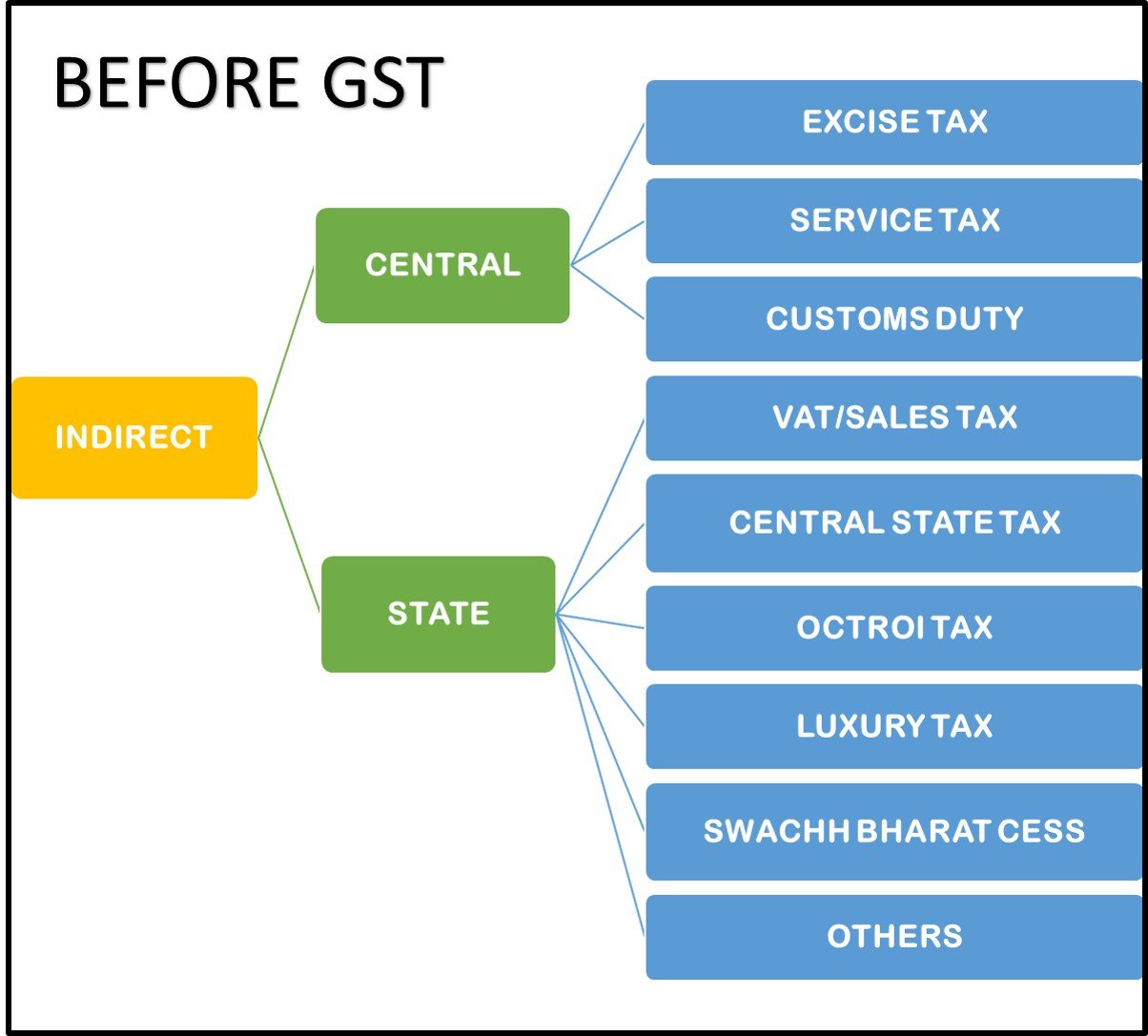

Before GST, the taxation system did go through a few amendments providing few welfare schemes for businesses but mainly for large scale ones. Small scale enterprises suffered back then for the cascading effect of indirect taxes. The reason behind this is the complexity of the taxation system that preceded GST.

GST was implemented towards a hope for a uniform taxation system. Meaning it would provide a single form of tax that is based on value-addition at the end product manufacturing. This tax would replace the multiple taxes levied for sales.

What’s New With GST?

Here’s a list of differences GST will make that was unheard of in the previous indirect taxation system:

Price Reduction of Products And Services

Manufacturers and service providers were previously had to pay taxes in the production cost of service and materials. With GST, the levy is only on value-addition instead of the previous system, which will reduce the effective cost imposed on the end-buyer.

Benefit For Consumers

GST is not only good news for businesses but also for consumers. Consumers now have to only pay for the taxes paid by the end supplier and not everyone who handled the product or service before them. This means that the entry fee, swachh bharat cess, education cess et cetera that the seller had to pay which was then added to the price is out of the equation now. This ensures that consumers are protected from a rise in the price of the product.

More Unified Approach

Although GST is being called one nation, one tax system, a more unified approach, is available. The current implementation is only the first phase, as this is a dual GST method (SGST and CGST) that will build the foundation of a more uniform integrated approach in the future.

Benefit In-State Revenue

State governments opposed GST implementation. They said that the state revenue will suffer from losses as the entry fee and other taxes paid for inter-state business would be reduced under a single tax system. To encourage them, the central government proposed a dual GST model wherein the state receives the SGST and CGST goes to the central government.

Easy Tracking

With the new model, the need for tracking 17 plus taxes has vanished. This is extremely beneficial for businesses as previously, with the multiple taxation system, there was a need to keep an account of all the different indirect taxes. Now with the SGST and CGST there exists a simplified GST format payment approach.

Call For Foreign Investment

With the ease of inter-state business in the country, the chances of a business to profit has increased. Businesses of all sizes can invite investors for expansion and profit making. This will clearly increase the foreign direct investment as well as indigenous investment. Investors will benefit from the measures of a uniform taxation system resulting in opening up of new sectors of business generating more employment.

A Change In Employment Rate

With a unified system in place, India will have a better chance of employment making good use of the private sector. When investors seek opportunities in the country, new sectors will open up to employ people. As businesses now stand a chance to expand without worrying about indirect taxes the chances for employment also increase.

Getting Rid Of Biasness

With the previous taxation system, there was the provision of levying multiple taxes on inter-state business. This meant making a product in-state “C” and selling it at a similar price in state “B” was not possible.

The end buyer had to pay to the added pricing partly which meant losing a consumer base simply due to higher prices. With the uniform system in place, its fair competition for micro, small, medium, and large business all across the country.

What Is The Impact Of GST On PPC?

PPC or production possibility curve is a two-good economy based model, which means there has been significant Impact of GST on Indian Economy in recent years. With the implementation of GST, the curve is expected to shift to the right, thereby indicating a boost in the economy. A simple understanding of the investment world will tell you how businesses are prone to look for establishments in a region with less market rigidity in terms of taxes.

An indirect tax system was a huge obstacle to such investments.

With the uniform tax bracket and exemptions, GST is supposed to roll out new opportunities for businesses to operate.

This will provide better free competition in the market, earn the government more revenues, and also help consumers get access to products at a cheaper rate than before. All such measures together will help with the betterment of the country’s economy.

While the methods of implementation of GST are debatable among people from all spheres of life in India, its timing and benefits are impeccable. The model has been devised to benefit all stakeholders instead of jeopardizing a single one out.

With the previous taxation system, it was either the buyer or the seller who had to bear the brunt of multi-layered taxation, but with this new measure, those days are gone.

GST – The Most Significant Tax Reform In India

gst in india, benefits of gst in india, gst explained, goods and services tax (gst) in india, goods and services tax (gst) in india b. viswanathan, gst site, gst pdf, www.gst.gov.in login portal, GST – The Most Significant Tax Reform In India